Employees contribution towards EPF 12 of 30000 3600. Both the rates of contribution are based on the total.

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

When wages exceed RM50 but not RM70.

. 88000 for members who turn 55 in 2019. Employees provident fund act 1991. Wages up to RM30.

Employers contribution towards EPF 3600 1250 2350. Updated PCB calculator for YA2019. Contribution Amount Employer Additional Contribution Amount Member Additional Contribution Amount Total Contribution Amount Monthly Gross Salary Employment 1 Active 2 On-Leave 3 Terminated Employment.

EPF tax relief limit revised to RM4000 per year. Is important to stay updated with the latest epf interest rates. Supply of Information under RTI Act 2005 to Sh.

Can an employee opt out from the Schemes under EPF Act. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. RECOGNISED PROVIDENT FUND AND CONTRIBUTION FROM APPROVED SUPERANNUATION FUND.

Employees Provident Fund SchemeThis is payable for all establishments that have or are employing 20 or more people and are engaged in an industry listed under one of the 180 industries under Section 6 of Act with 12 of the basic pay Daily Allowance food concession along with retaining allowance if there are any up to a maximum. 65 of the employees salary. Examples of Allowable Deduction are.

9152014 52201 PM. 71 The trustees of a Recognized Provident Fund or any person authorized by the regulations of the Fund to make payment of accumulated balances due to employees shall in cases where sub-rulel of Rule 9 of Part A of the Fourth Schedule to the. 57200 from 1 January 2019.

Change in the SSS Contribution rate is from 120 percent to 13 percent. EPF Contribution_ Govt to contribute to EPF only for new employees registered till Mar 31 2019pdf - SECTIONS ET APPS Home Wealth ENGLISH Tax. Removed YA2017 tax comparison.

Jadual PCB 2020 PCB Table 2018. EPF Contribution Third Schedule. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 12001 to 14000 1900 1300 3200 From 14001 to 16000 2100 1500 3600 From 16001 to 18000 2400 1700 4100 From 18001 to 20000 2600 1800 4400 From 20001 to 22000 2900 2000 4900.

For employees who receive wagessalary of rm5000 and below the portion of employees contribution is 11 of their monthly salary while the employer. Total EPF contribution every month 3600 2350 5950. The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years. Central Provident Fund is the social security savings plan in Singapore CPF Employer Employee contribution Rate helps Singaporeans build retirement saving. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

Wages up to RM30. Examples of Allowable Deduction are. When wages exceed RM30 but not RM50.

Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. Government of India will pay EPF contribution of both employer and employee 12 percent each for the next three months so that nobody suffers due to loss of continuity in the EPFO contribution This is for those establishments that have up to 100 employees and 90 percent of whom earn under Rs 15000 monthly wage This will benefit about 80 Lakh employees and. View EPF Contribution_ Govt to contribute to EPF only for new employees registered till Mar 31 2019pdf from MBA 111 at Pondicherry Central University.

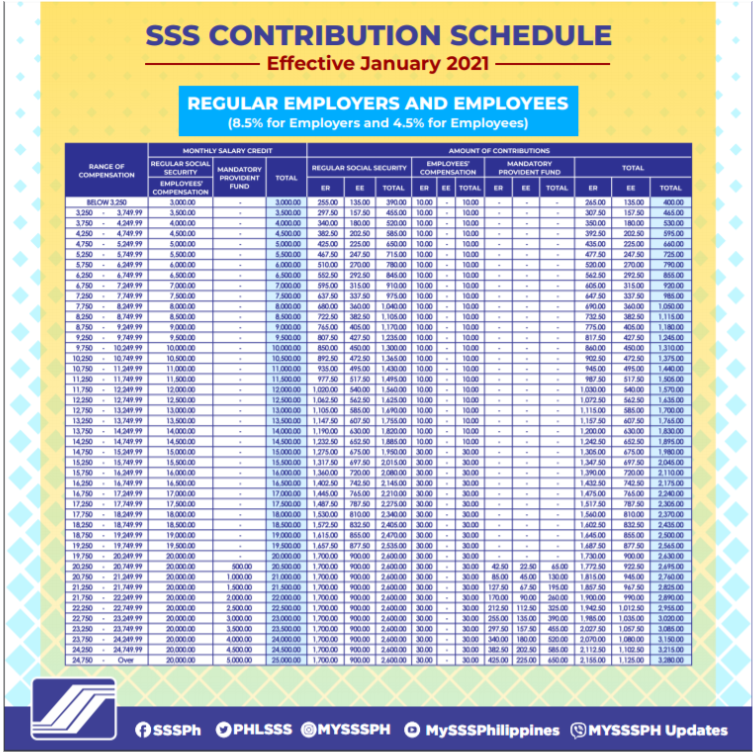

Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. Where in the old rate Employee share is 40 percent and Employer Share is 80 percent while the new 2021 Contributions rate Employee Share is 45 percent and Employer share is 85 percent.

From the old 2020 rate minimum Monthly Salary Credit is 2000 while the maximum. HONoWSU6 12019Income TaxPart-I E-33306 dated 15072022. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 8001 to 10000 1300 700 2000 From 10001 to 12000 1600 900 2500 From 12001 to 14000 1900 1000 2900 From 14001 to 16000 2100 1200 3300 From 16001 to 18000 2400 1300 3700.

When wages exceed RM70 but not RM100. SIP EIS Table. Contribution By Employer Only.

A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. Employee EPF contribution has been adjusted to follow EPF Third Schedule. Employers contribution towards EPS subject to limit of 1250 1250.

Employers contribution towards EPF 367 of Rs 50000 Rs 1835. Can an employee opt out from the Schemes under EPF Act. Contribution schedule for regular social security.

91800 7650 per month. January 2 2019 at 343 pm. Corrigendum to circular dated 06042022 on Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit.

EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000.

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

Mandatory Seeding Of Aadhaar Number With Uan Till 30 11 2021 Employment Government Organisation

How To Calculate Your Sss Contribution Sprout Solutions

Hr Talk Top 13 Questions Answered On The New Sss Mandatory Provident Fund Aka Wisp Program Tina In Manila

30 Nov 2020 Bar Chart Chart 10 Things

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Employees Provident Fund Contribution Calculation Otosection

Best Tax Free Bonds To Invest In 2020

20 Kwsp 7 Contribution Rate Png Kwspblogs

Ppf 2019 Public Provident Fund Debt Investment Investing

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Sss Contribution Table 2022 Sss Membership Benefits

Eps Vs Nps Vs Apy Retirement Benefit Comparison

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

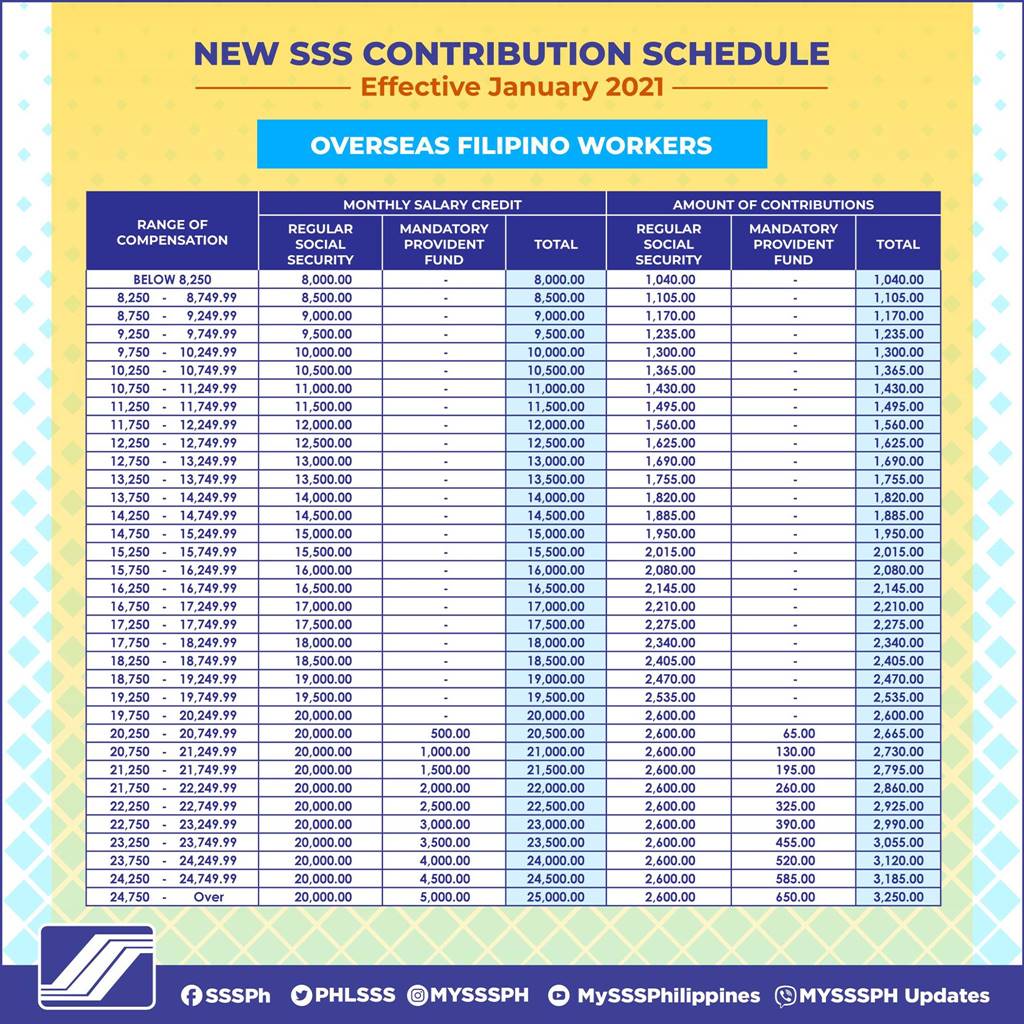

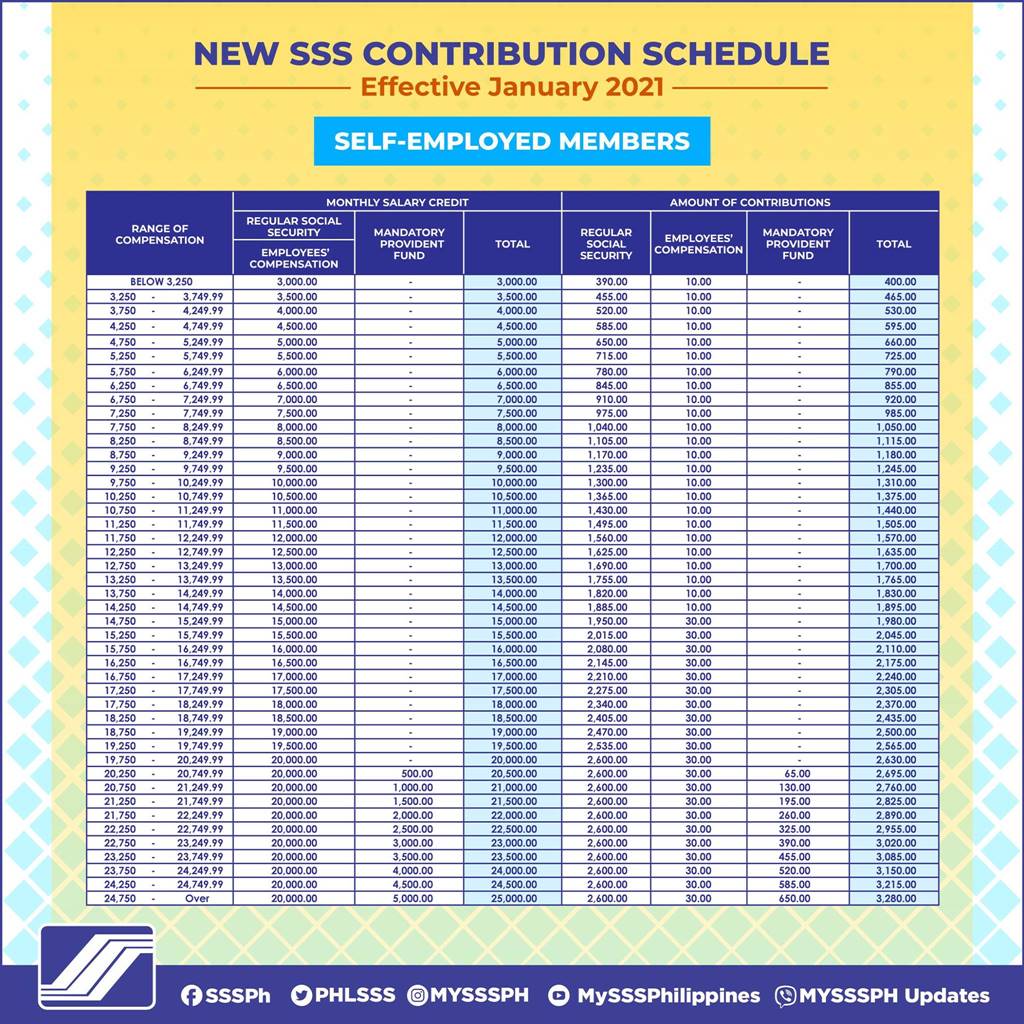

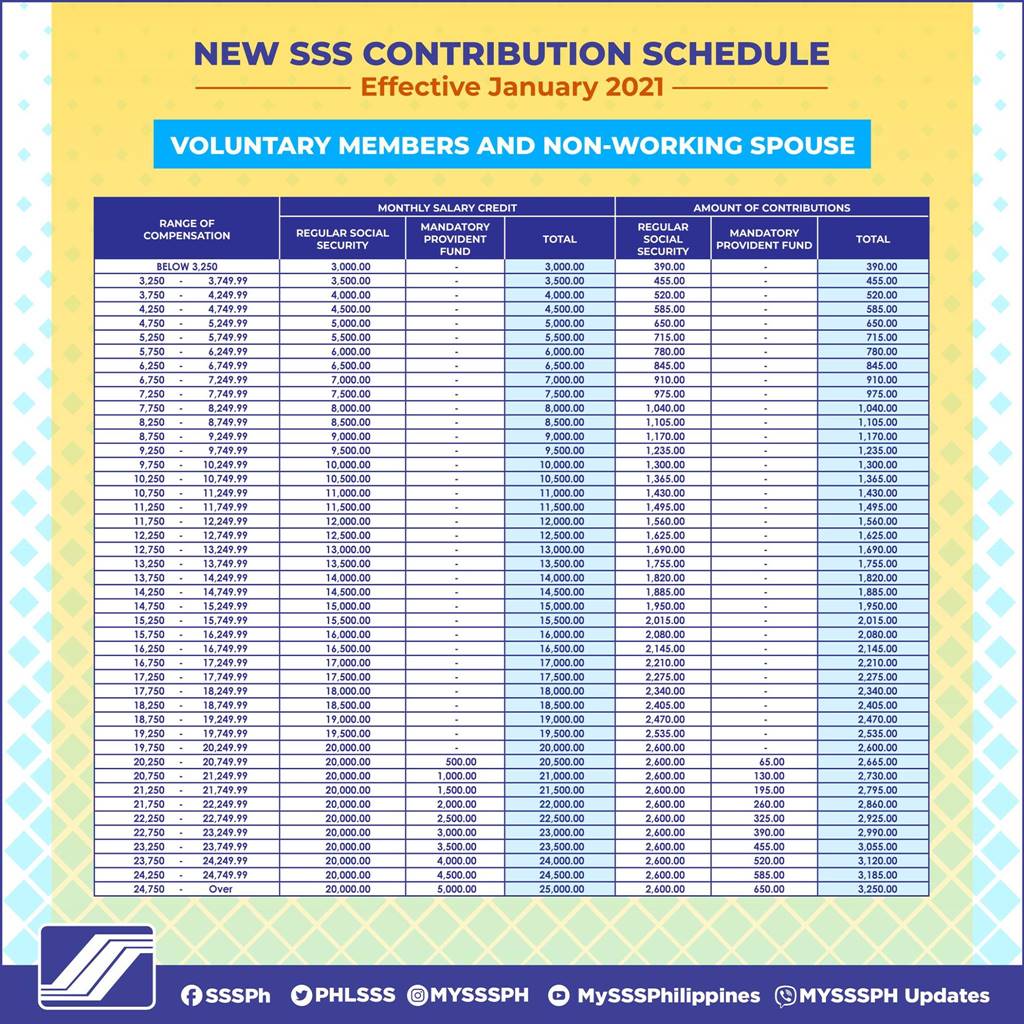

2021 Sss Contribution Table For Employees Self Employed Ofw Voluntary Members Pinoy Money Talk